For years, one of the biggest frustrations for freelancers in Nigeria has been how to withdraw money from PayPal in Nigeria.

Although PayPal is a global leader in online payments, it’s still heavily restricted in Nigeria, mainly due to the many fraud cases linked to the country. This creates a huge problem to many legit online freelancers looking to get paid online via Paypal.

In this article, we explore the real, practical, and legal ways to withdraw money from PayPal in Nigeria, the limitations you must understand, and the platforms that can help you bridge the gap.

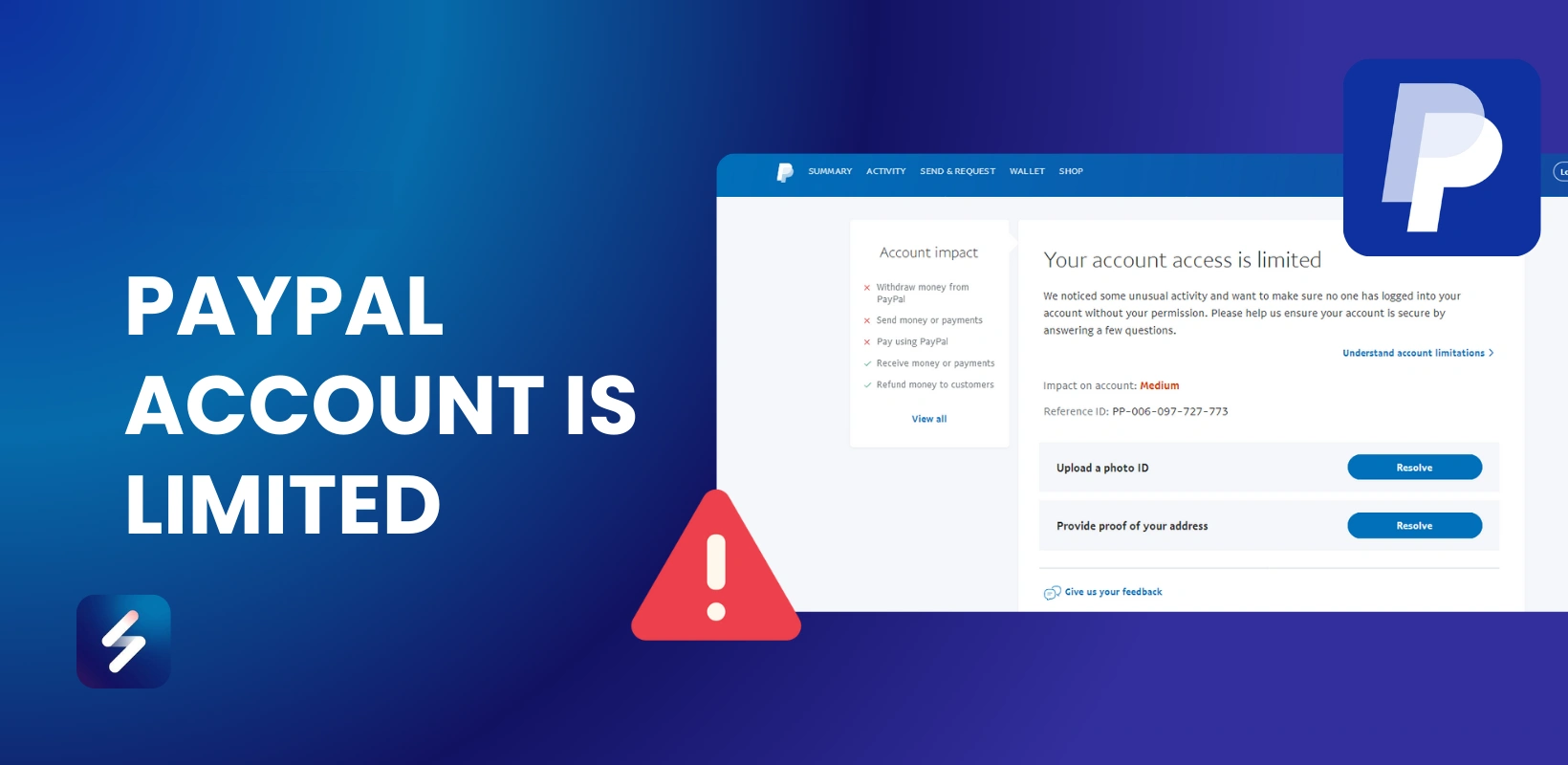

PayPal Limitations in Nigeria

Technically, Nigerians can open and verify PayPal accounts, send payments, and shop online using Paypal. However, PayPal accounts in Nigeria cannot receive money, whether personal or business.

That means you cannot log in to your PayPal account in Nigeria and directly withdraw PayPal funds to a local Nigerian bank account. According to Prestmit, this policy has remained unchanged for years.

Because of this limitation, people who earn online from freelancing, affiliate marketing, or e-commerce need Paypal alternatives in Nigeria.

Many Nigerians now use foreign virtual bank accounts, dollar debit cards like UBA AfriCard, or fintech platforms like Grey to receive and withdraw money from PayPal in Nigeria. Each method has different advantages, risks, and legal considerations.

How to Withdraw Money from PayPal in Nigeria

Given the Paypal limitations in Nigeria, here is a quick summary of legal methods you can use to withdraw PayPal funds in Nigeria:

1. Using Virtual Foreign Bank Accounts from Fintechs

The most common method used to withdraw from Paypal in Nigeria is virtual foreign bank accounts provided by fintechs like Grey. These platforms give you a verified USD, GBP, or EUR account that you can link to PayPal.

Once your money arrives in the Grey account, you can convert them to Naira and transfer directly to your Nigerian bank account. According to Grey, this process is fully legal as long as your KYC documents match your PayPal details.

2. Using the UBA AfriCard

Another way to receive money via Paypal in Nigeria is via the UBA AfriCard, a prepaid dollar card widely used in Nigeria.

You can link your UBA AfriCard to PayPal and transfer your PayPal balance to it. From there, you can withdraw at ATMs or use trusted exchangers such as FnfSwap to convert the balance into Naira. This approach is safe and popular, though exchange rates and withdrawal limits vary.

3. Using Licensed Exchangers

Some Nigerians also rely on licensed exchangers and fintech intermediaries to receive money via Paypal in Nigeria.

Platforms like Flutterwave occasionally enable PayPal integrations for businesses, while receiving money via Payoneer provides a seamless international payment solution.

However, not all exchangers are trustworthy, so you must confirm credibility, check user reviews, and ensure the platform complies with anti-money laundering regulations before moving large sums.

4. Register a Business in a PayPal-supported country.

A more advanced but stable method is registering a business in a PayPal-supported country.

This allows full access to PayPal’s receiving and withdrawal features, giving you a straightforward way to receive money via Paypal into a foreign bank account and legally remit funds back to Nigeria.

While more expensive and complex, this option is useful for Nigerians running serious online businesses.

Summary Table of PayPal Withdrawal Options in Nigeria

| Withdrawal Method | Works in 2025? | Key Requirements | Risks | Legality |

|---|---|---|---|---|

| Nigerian PayPal to local bank | ❌ Not possible | Not supported by PayPal Nigeria | Risk of scams if attempted | Not legal |

| Grey virtual foreign account | ✅ Yes | Verified Grey account, matching KYC | Fees, conversion rates | Fully legal |

| UBA AfriCard (Dollar card) | ✅ Yes | UBA AfriCard linked to PayPal | ATM withdrawal limits, rates | Legal |

| Licensed exchangers (e.g., FnfSwap) | ✅ Yes | Verified PayPal + exchanger | Risk if exchanger is unlicensed | Legal if regulated |

| Registering foreign company | ✅ Yes | Foreign entity setup | Cost, double taxation | 100% legal |

Receive Money via Paypal in Nigeria: Legal and Policy Constraints

PayPal enforces strict country rules, so when exploring ways to withdraw money from PayPal in Nigeria, it is crucial to stay compliant. Here are several key Paypal policy consraints to keep in mind:

- PayPal’s Terms of Use and Country-Policies: Violating PayPal’s terms (for example by supplying false documents, misrepresenting your country of registration, etc.) can lead to account limitation, suspension, or loss of funds. Always match account name, address, and identity documents.

- Nigerian Regulation: The Central Bank of Nigeria (CBN) regulates foreign exchange, domiciliary accounts, and cross-border money flows. While receiving foreign currency is legal through authorized routes, you cannot use illicit or unlicensed exchangers without risk.

- Taxation: Money earned from abroad in Nigeria may be considered income, especially for freelancers/businesses. You should report them appropriately.

- Anti-Money Laundering / KYC Rules: Financial platforms require know-your-customer (KYC) compliance; documents must be valid and match your profile.

- Exchange Rate & Bank Charges: Even through legal means, you’ll incur currency conversion fees, bank transfer charges, and sometimes platform charges.

Best Practices to Stay Safe

If you want to withdraw money from PayPal in Nigeria without problems, always ensure that your PayPal details match your bank or card details.

Keep all transaction records, especially for freelance jobs or online sales. Use trusted services like Grey, UBA, or verified exchangers, and test with small amounts before moving large sums.

Finally, never rely on illegal tricks or backdoor hacks – PayPal can freeze your account permanently. That’s how Nigeria ended up in Paypal’s blacklist in the first place!

Conclusion

The reality is that withdrawing PayPal funds legally in Nigeria in 2025 still requires creativity and trusted intermediaries.

Direct withdrawal from PayPal to Nigerian banks is impossible, but with Grey virtual accounts, UBA AfriCard, or reputable exchangers, Nigerians can still access their international earnings safely.

For larger businesses, setting up a foreign entity remains the most stable long-term solution.

Can Nigerians withdraw money from PayPal in 2025?

Yes, but not directly into local Nigerian bank accounts. You can withdraw money from PayPal in Nigeria legally using platforms like Grey, UBA AfriCard, or through licensed exchangers that convert PayPal balances into Naira.

What is the best way to withdraw PayPal in Nigeria?

The most reliable method in 2025 is using Grey virtual accounts linked to PayPal. Other safe options include UBA AfriCard and trusted PayPal exchangers that comply with Nigerian financial laws.

Can PayPal send money to Nigerian banks?

No. PayPal Nigeria accounts do not allow direct withdrawals to Nigerian banks. To move money from PayPal to a Nigerian account, you must use an intermediary such as Grey or a linked dollar card.

What are PayPal limitations in Nigeria?

PayPal accounts in Nigeria can send payments, shop online, and make subscriptions, but they do not allow receiving funds directly.

Which banks in Nigeria accept PayPal withdrawals?

Currently, no Nigerian bank directly accepts PayPal withdrawals. However, banks like UBA issue dollar-denominated prepaid cards (AfriCard) that can be linked to PayPal for indirect withdrawals.

What are the PayPal alternatives in Nigerian?

Many Nigerians use Payoneer, Wise, Grey, and Flutterwave as alternatives to PayPal. These platforms often provide simpler ways to receive international payments.